Why Are Women Leading the Growth in Adult Product Sales?

The adult product industry is booming, but one trend stands out: female consumers are driving its explosive growth. In 2024, women accounted for 72.4% of global sex toy revenue, and 82% of U.S. women own at least one adult toy. This shift isn’t random—it’s fueled by evolving cultural norms, innovative product design, and a growing emphasis on sexual wellness. For retailers and wholesalers, understanding why women dominate this market is critical to capturing demand and staying competitive. Let’s dive into the data, consumer behaviors, and actionable insights shaping this revolution.

Women dominate the adult product market due to increased sexual wellness awareness, product innovation tailored to female needs, and cultural destigmatization. Key drivers include the popularity of discreet, health-focused devices like rabbit vibraters, clit vibraters, and pink rabbit vibraters, alongside the rise of e-commerce platforms that prioritize privacy. Statista reports that 72.4% of sex toy revenue in 2024 came from female buyers, with pelvic floor health and stress relief cited as major motivators. Retailers must prioritize female-centric designs, educational marketing, and secure online shopping experiences to capitalize on this trend.

Keep reading to uncover:

How cultural shifts are reshaping purchasing habitsWhy specific products like female butt plugs, clit vibraters, and rabbit vibraters outperform others

Regional differences in markets like Japan, Brazil, and Germany

Actionable strategies for retailers to engage this lucrative demographic

1. What Do the Sales Data Reveal About Female Consumers?

72.4% of 2024 sex toy revenue came from women (Statista, 2024).82% of U.S. women own at least one sex toy, compared to 34% of French men who shop online for adult products (Statista, 2023).

E-commerce dominance: Women prefer online purchases for privacy, with platforms offering discreet packaging and targeted ads for products like female sex toys, clit vibraters, and rabbit vibraters.

Key Insight: Female buyers prioritize convenience, safety, and product aesthetics. Pink and ergonomic designs (e.g., pink rabbit vibraters ) resonate strongly, as do devices marketed for “wellness” rather than purely pleasure.

2. What Factors Are Driving Female-Led Growth?

A. Cultural Normalization of Female Sexuality

Movements like #MeToo and body positivity have reduced stigma around female pleasure.Social media influencers and brands (e.g., Lelo, Dame) openly discuss female adult toys, framing them as tools for self-care.

B. Health and Wellness Benefits

Pelvic floor strengthening: Products like Kegel trainers are marketed to postpartum women and fitness enthusiasts.Stress relief: 58% of women cite stress reduction as a reason for using vibraters (Straits Research, 2025).

C. Product Innovation

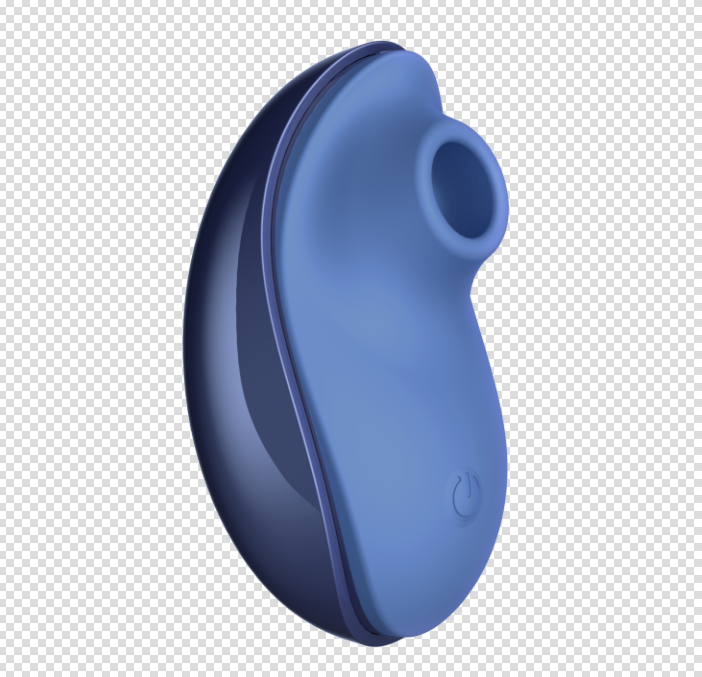

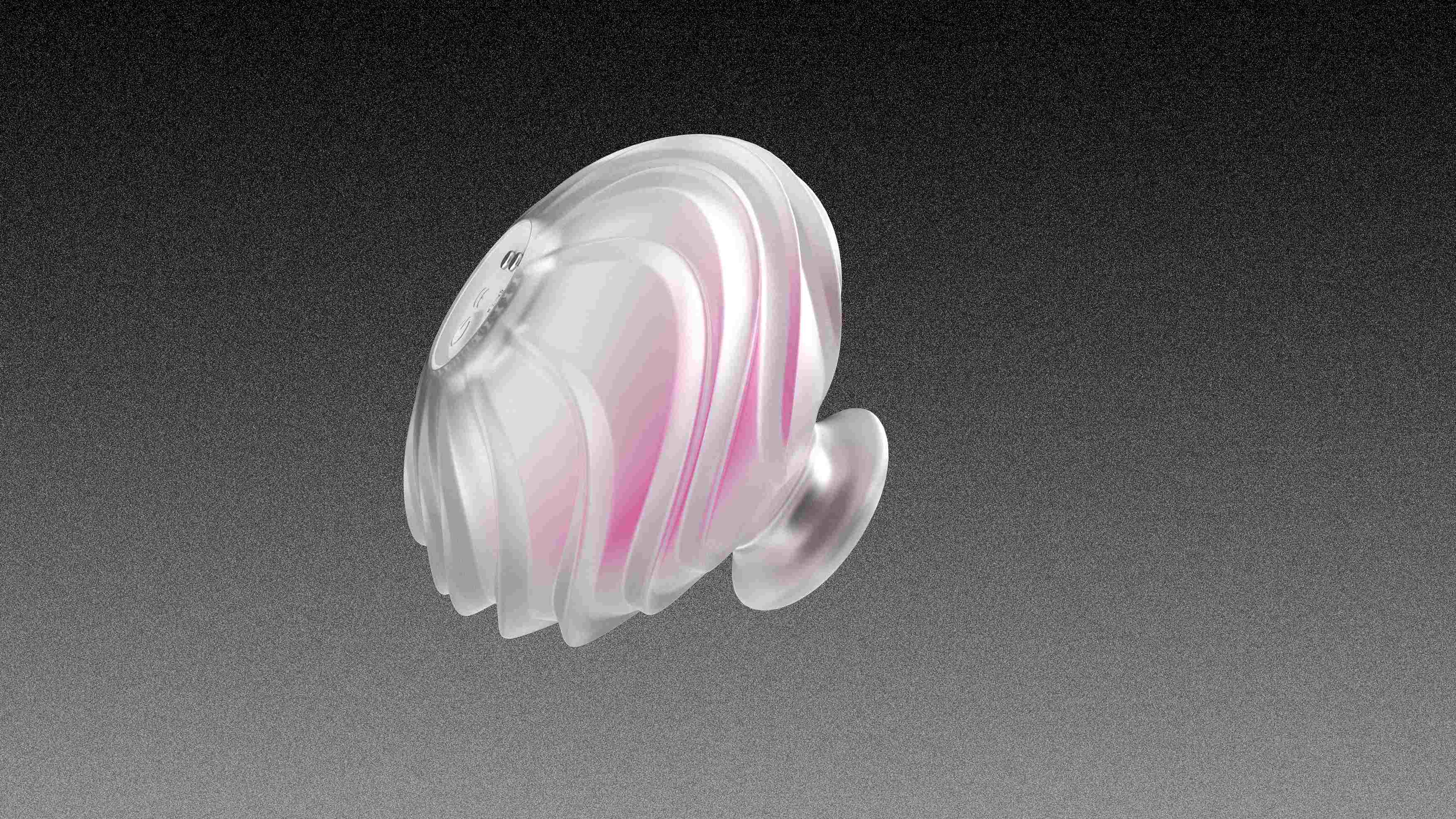

Clit vibraters: Compact, targeted devices like clit vibraters cater to precise stimulation, with brands like Womanizer leading in suction technology.Rabbit vibraters: Dual stimulation (clitoral + G-spot) designs remain iconic, especially pink rabbit vibraters with ergonomic shapes.

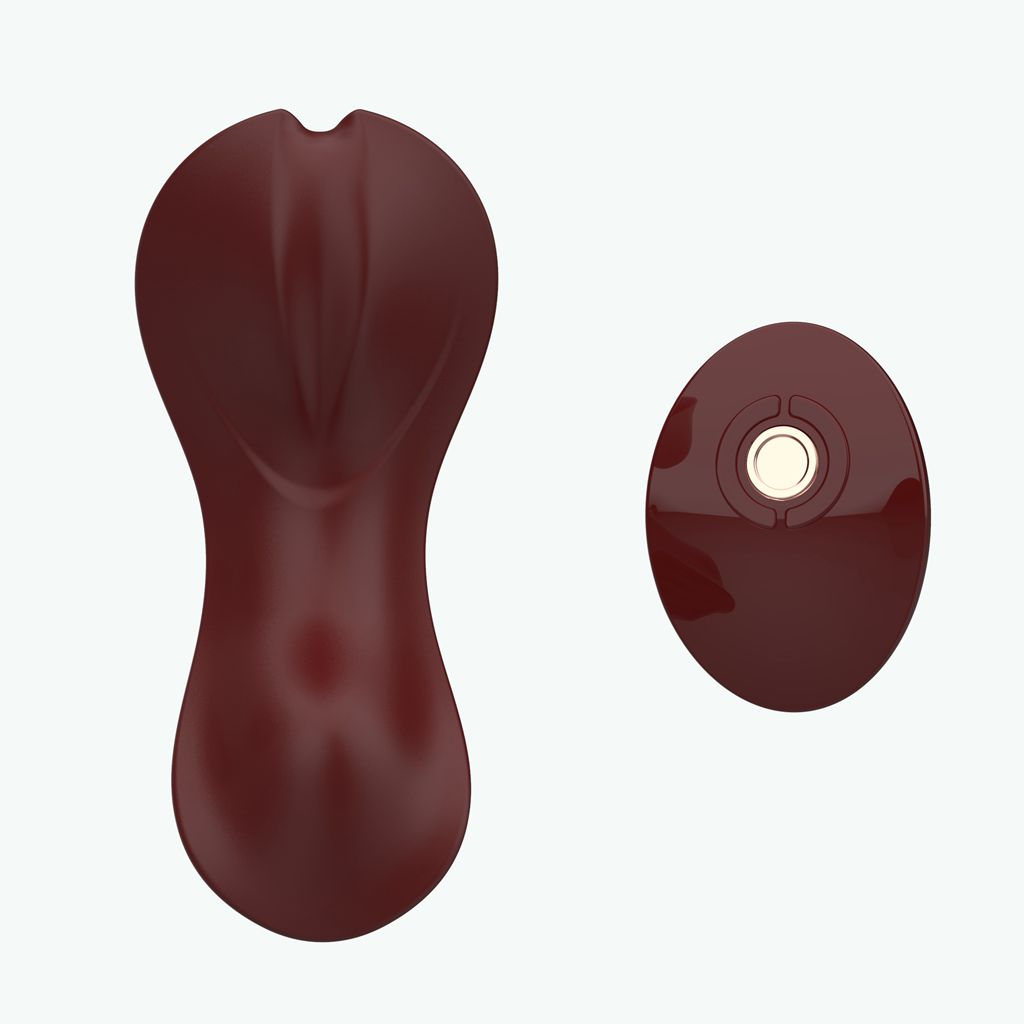

Female butt plugs: Anal toys are rebranded as “beginner-friendly” with tapered tips and body-safe silicone.

3. Regional Differences: Why Do Gender Trends Vary Globally?

A. Europe

France: 34% of male shoppers buy adult toys online vs. 27% of women (Statista, 2024).Cultural factor: France’s liberal attitude reduces stigma for men, but women still drive premium purchases (e.g., luxury clit vibraters).

Germany: 63% of sex toy buyers are women, with high demand for medical-grade silicone rabbit vibrators due to strict product safety laws.

Sweden: Gender-neutral marketing thrives, but 68% of online shoppers are women seeking eco-friendly products like biodegradable female butt plugs.

B. Latin America

Brazil: Female shoppers account for 61% of sales, driven by wellness campaigns promoting clit vibrators on Instagram. However, conservative regions see higher male purchases (47%) of novelty items like male masturbators.Mexico: 55% female buyers focus on discreet pink rabbit vibrators, while men dominate B2B sales for erotic lingerie.

C. Asia

Japan: 71% of sex toy revenue comes from women. Cultural privacy norms boost online sales of compact, whisper-quiet clit vibrators.South Korea: Female-led growth (69%) is fueled by K-beauty-style marketing, with pastel-colored female sex toys sold alongside skincare products.

D. North America

U.S.: 82% of women own sex toys, prioritizing pelvic health devices like clit vibrators and Kegel trainers.Canada: 76% of female buyers shop online, with rabbit vibrators as top sellers.

Takeaway: Localize campaigns. In conservative markets (e.g., Brazil’s rural areas), emphasize “health” over “pleasure.” In progressive regions (Germany, Sweden), leverage inclusivity and sustainability.

4. How Can Retailers and Wholesalers Adapt?

A. Stock Female-Centric Designs

Prioritize body-safe materials (medical-grade silicone, non-porous).Offer vibrators in pastel colors (e.g., pink rabbit vibrators) and compact sizes like clit vibrators for discretion.

B. Educate Consumers

Create blogs/videos on pelvic floor health using keywords like female adult toys and clit vibrators.Partner with gynecologists or sex therapists for credibility.

C. Optimize E-Commerce

Use SEO terms: “best clit vibrator for beginners,” “discreet female butt plugs.”Ensure mobile-friendly checkout and encrypted payment gateways.

5. The Role of Quality and Safety in Female Purchasing Decisions

ISO certification: 78% of women research material safety before buying (Straits Research, 2025).Packaging: Use plain boxes and avoid explicit imagery.

Pro Tip: Highlight certifications (e.g., FDA-compliant, phthalate-free) on product pages for female sex toys and clit vibrators.